Imagine a world where paying for goods didn’t involve the quick swipe, dip, or tap of a card. Sounds inconvenient, doesn’t it? The credit card swiper, though small and often overlooked, revolutionized how we handle transactions. From its early roots in manual processes to today’s cutting-edge technologies, the swiper’s evolution tells a story of innovation that reshaped commerce forever.

Life Before the Credit Card Swiper

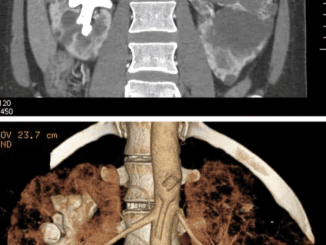

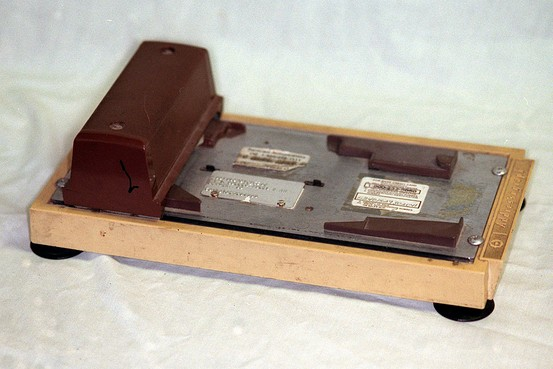

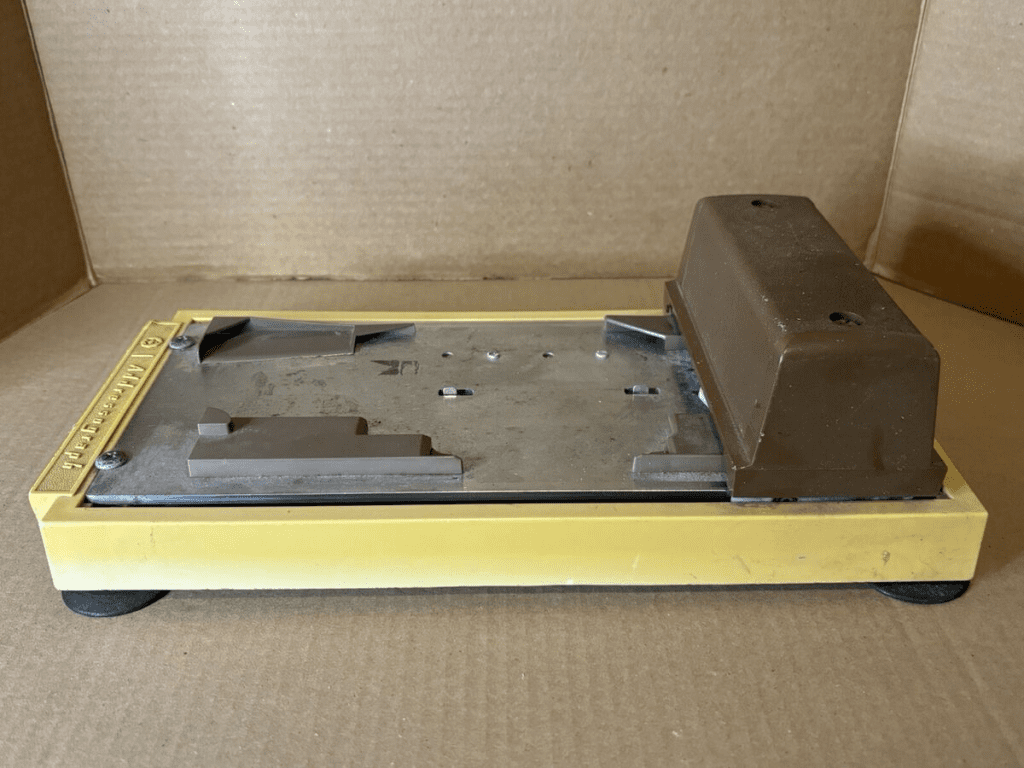

Before credit card swipers became ubiquitous, transactions were anything but seamless. Early credit cards, introduced in the mid-20th century, relied on clunky devices called credit card imprinters, often referred to as “knuckle-busters.”

How the Imprinter Worked

Merchants placed the credit card on a flat metal bed and used carbon paper to capture the card’s details. The imprint was then sent to banks for manual authorization, which could take hours or even days. This process was inefficient and prone to errors, leaving customers and merchants frustrated.

Worse yet, the carbon copies exposed sensitive cardholder information, increasing the risk of fraud. It was clear that a more secure, faster solution was needed. Enter the magnetic stripe and the revolutionary credit card swiper.

The Magnetic Stripe Revolution

In the late 1960s, IBM engineer Forrest Parry developed the magnetic stripe, a groundbreaking technology that transformed credit card functionality. The stripe stored encoded data, such as account numbers and expiration dates, enabling electronic machines to read the information instantly.

Why the Magnetic Stripe Changed Everything

- Speed and Efficiency: Transactions that once took minutes now happened in seconds.

- Improved Security: The encoded stripe reduced errors and made tampering more difficult.

- Global Standardization: The magnetic stripe became the universal standard, facilitating international transactions.

The magnetic stripe set the stage for the first credit card swipers, forever changing how we shop.

The Arrival of the Credit Card Swiper

By the 1970s, the first generation of credit card swipers emerged alongside electronic payment networks. These devices were simple yet transformative, marking the beginning of modern payment systems.

How Early Swipers Worked

- Data Reading: Customers swiped their card through the device, which read the magnetic stripe’s encoded information.

- Authorization: The swiper transmitted the data to a payment processor for verification.

- Receipt Printing: Once approved, a receipt was generated for the customer to sign.

This process drastically reduced wait times and improved accuracy, making transactions smoother for merchants and consumers alike.

Growing Pains: The 1980s Declined Card Dilemma

By the 1980s, credit card usage was widespread, but declined cards brought unique challenges. Store clerks often had to manually call banks for verification, a process that could take several awkward minutes. If the card was deemed invalid, the clerk might even destroy it on the spot, much to the customer’s humiliation.

While this practice seems extreme by today’s standards, it highlights the growing pains of a rapidly evolving payment system.

The Evolution of Credit Card Swipers

The credit card swiper has continuously adapted to meet the demands of an ever-changing financial landscape.

From Magnetic Stripes to EMV Chips

By the early 2000s, the limitations of magnetic stripes became evident as fraudsters devised methods to skim card data. To counter this, EMV chip technology was introduced.

Unlike magnetic stripes, EMV chips generate a unique transaction code for every purchase, significantly reducing fraud risks. Swipers evolved to include chip readers, allowing customers to “dip” their cards rather than swipe them.

The Era of Contactless Payments

Today’s credit card swipers often include NFC (Near-Field Communication) technology, enabling contactless payments. Customers can now tap their cards or smartphones on the reader, completing transactions faster and more securely than ever.

The Rise of Mobile Card Readers

One of the most significant innovations in swiping technology has been the development of mobile card readers. Compact devices from companies like Square and PayPal connect to smartphones or tablets, enabling small businesses and freelancers to accept payments with ease.

Why Mobile Readers Are Game-Changers

- Accessibility: Small businesses no longer need expensive POS systems.

- Portability: Vendors at markets and events can process payments on the go.

- Affordability: These devices are cost-effective, making credit card acceptance more inclusive.

Mobile readers have democratized payment systems, empowering businesses of all sizes to thrive in a cashless economy.

Cultural Impact: The Swipe That Changed the World

The act of swiping a credit card has become second nature to consumers worldwide. From its debut in the 1970s to its modern iterations, the credit card swiper has fundamentally changed how we approach transactions.

Even as chip readers and digital wallets gain traction, the iconic swipe remains a symbol of convenience and progress. For many, it evokes nostalgia—a reminder of simpler times when shopping meant sliding a card through a trusty swiper.

What’s Next for the Credit Card Swiper?

As technology continues to advance, the future of payment systems is leaning toward fully digital solutions. Biometric authentication, cryptocurrency wallets, and AI-powered fraud detection are reshaping how we think about security and convenience.

While the credit card swiper’s role may evolve, its legacy as a catalyst for modern commerce will endure.

Conclusion: The Enduring Legacy of the Credit Card Swiper

The credit card swiper is more than just a tool; it’s a testament to human ingenuity. From the inefficiencies of manual imprinters to the sleek, contactless readers of today, the swiper bridged the gap between past and future, making transactions faster, safer, and more accessible.

As we move toward a digital-first world, the credit card swiper remains a silent hero, reminding us of the power of innovation. It’s a small device with a big impact, shaping the way we live, shop, and connect—one swipe at a time.